In sports, when one team has a distinct advantage over an opposing team, it’s used aggressively to win the game. Last Sunday’s Super Bowl is a prime example, with the Tampa Bay Buccaneers using their advantages to soundly defeat the Kansas City Chiefs.

The same can be said in politics. The ruling party—in this case, Democrats—usually holds a significant advantage, but this should be used wisely and fairly to benefit the people.

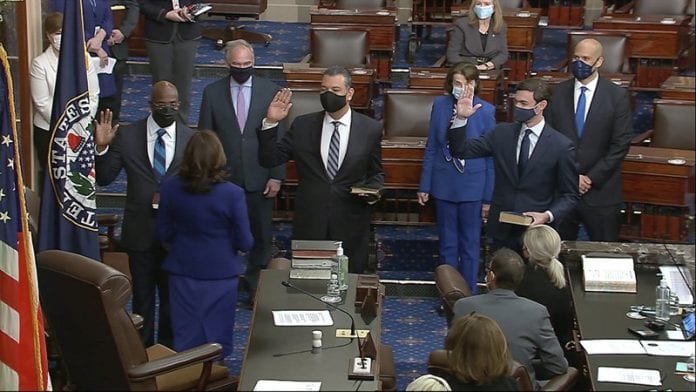

After years of trying to negotiate blockades by the Republican Party, more pointedly from a Republican-controlled U.S. Senate, the Democrats now control the White House, the House of Representatives, and the Senate. Democrats now have a distinct advantage to pass legislation Republicans snubbed when they held power.

While President Joe Biden touted bipartisan cooperation during his presidential campaign, and in his inaugural address, offered to preside with a bipartisan approach, such bipartisanship cannot be realized if one party refuses to cooperate.

When he took office, Biden proposed a $1.9 trillion COVID-19 relief package—the American Rescue Plan—which includes, among other benefits, one-time relief payments of $1,400 each to qualified Americans; continued monthly unemployment benefits, and funds to assist states with implementation of COVID-19 vaccination plans.

While Republicans in the U.S. House and Senate seem increasingly less inclined to support the plan, arguing it’s too large, the rules of both chambers allow Democrats to approve the related bill when it comes up for a vote on their own, through a legal process called Budget Reconciliation.

With millions of American still experiencing severe financial challenges as COVID-19 continue to rob jobs and incomes, there’s urgency in passing the American Rescue Plan when it’s presented to both houses. If the Republicans continue to refuse to cooperate with the Biden administration, Democrats have the advantage and shouldn’t hesitate to use it to approve the plan.

But, even with this advantage, there are indications of divisions within the Biden administration, particularly related to the individual relief payments. While Biden is adamant the payments will be $1,400, some argue payments shouldn’t be made to individuals earning high incomes, for example, over $75,000 annually.

Without analysis, it seems unwarranted for the government to allocate relief funds to employed individuals, earning, say, $75,000 a year. Undoubtedly, such a salary is very attractive and beneficial for individuals working in a low-tax state like Florida. But what really matters is the real income earned by the individual.

What of Real Income?

There is a vast difference between the real income—the income after inescapable expenses—of a single individual unburdened with the expenses of a family and another individual who is the head-of-household of a family of four. Economic analysis suggests the single individual earning $75,000 even taking into account rent/mortgage, car payments, and taxes, averages an estimated annual real income of $40,000, while the person who heads the family of four has a real income average of about $15,000.

Bearing this in mind, it’s difficult to implement a broad policy where individuals earning high salaries shouldn’t receive relief funding. It seems a better policy is to take into consideration both income and family size, or the taxpayer-dependent ratio, in deciding who gets the relief funding and how much.

Some people argue the relief payments should be distributed by other agencies besides the IRS. But it’s the IRS, based on tax returns submitted by Americans, that is best equipped to determine the real income of individuals related to their dependents.

It can be agreed single individuals earning “higher-end” salaries, not having stated dependents, should receive lower relief payments than those with verifiable dependents.

The relief payments have two primary objectives. First, assisting people experiencing financial challenges because of the COVID-19 pandemic. Secondly, generating cash into the national economy to stimulate economic development.

Individuals with a high real income are less likely to spend their relief checks and are more likely to place them into saving accounts or pay down credit card bills. While maintaining saving accounts is a positive financial strategy for individuals and families, it doesn’t help the economy recover from a downward spiral. The more money consumers spend on goods and services, the more cash goes to businesses—small, medium, and large—and the better it is for these businesses to expand employment, and ultimately the better are the chances for economic growth.

While it’s incumbent on the Biden administration to take advantage of the Budget Reconciliation to approve the American Rescue Plan, it must act wisely to ensure the relief goes to Americans who need it the most.

If this plan is approved, it means the federal government, would have approved over $5 trillion to stimulate the U.S. economy within a year. This isn’t money plucked from the air without repayment consequences. Even if the Federal Reserve cushions this huge bill by selling government treasury bills, ultimately the responsibility will fall on every American in some form of taxes. So, the government is urged to allocate the funds within the American Rescue Plan wisely.