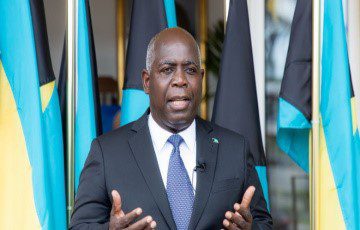

The government of The Bahamas is defending its decision to introduce the country’s first-ever corporate income tax, with Prime Minister Phillip Davis stressing that the new legislation will only apply to large multinational corporations. Davis highlighted that the tax could generate up to US$140 million in revenue for the country.

Speaking in Parliament, the Prime Minister clarified that the Domestic Minimum Top-up Tax is specifically aimed at multinational corporations operating in The Bahamas with annual earnings exceeding 750 million Euros (approximately US$800 million). This measure is part of the country’s efforts to align with international tax standards, particularly the OECD’s Global Minimum Tax framework, which seeks to prevent tax avoidance by large, profit-shifting corporations.

“If you do not own a multinational entity making 750 million Euros per year or more, this tax does not apply to you,” Davis told legislators, addressing concerns about new tax burdens on local businesses and citizens.

The Prime Minister noted that his administration has actually reduced taxes for most Bahamians over the past three years, including lowering value added tax (VAT) from 12 to 10 percent and reducing customs duties on various essential items.

The new legislation aligns with a global initiative involving 140 countries that have agreed with the Organisation for Economic Co-operation and Development (OECD) on implementing a 15 percent minimum corporate tax rate, effective January 1, 2024.

Davis explained that the OECD’s push aims to prevent corporations from exploiting low-tax jurisdictions while generating revenues elsewhere. “The OECD argues that this change will produce a more fair global tax regime,” he said.

He emphasized that if The Bahamas doesn’t implement this tax, other jurisdictions would collect these revenues instead. “This would rob us of the opportunity for our people to benefit from the presence of these corporations,” Davis stated.

The Prime Minister added that The Bahamas is actively participating in shaping international tax policies, with Attorney General L. Ryan Pinder serving on the UN Committee charged with ensuring fair application of standards.

The expected US$140 million in revenue will support government programs and strengthen the country’s fiscal position, according to Davis, who reiterated that the legislation aims to generate significant revenue without burdening Bahamian citizens or businesses.